One of the best methods of payment for online transactions is Neteller. The majority of gambling sites also allow it as a deposit option because of its acceptance and popularity.

You’ve come to the correct place if you enjoy gambling and want to use Neteller to finance your casino account. Everything you need to know about it and how to utilize it to make a deposit will be covered in this post.

What You Should Know About Neteller

One of the most popular e-wallet for online gaming is Neteller. It handles billions of dollars annually and runs in more than 200 nations, including India. The company, Optimal Payments Limited, launched the brand in 1999. The Financial Conduct Authority of the United Kingdom, one of the harshest regulatory bodies, is in charge of overseeing how it does business.

Neteller India offers convenient financing methods including bank transfers and credit cards. Players may use it for online payments and transfers as well as to make money deposits at online betting sites. Players get access to their account’s balance. In addition to offering gifts to its subscribers during promotional events, it also provides payment options besides the e-wallet.

The major benefit is that Neteller accepts INR, allowing Indians to conduct financial transactions without having to exchange their currency. Convenient currency exchange raises the expense of gambling.

In India, Neteller has the best success percentage of any accepted payment method. There haven’t been any instances of unsuccessful deposits or transfer delays.

How to Neteller Login?

It’s easy to sign up for a Neteller account from India. Just provide your name, email address, and password to get started.

Once opened, the user must pick the nation and currency. Once a currency is selected, it cannot be altered. To demonstrate that you are a real person, fulfill the KYC criteria. After the verification process, your Neteller login will be completed.

Neteller India Verification Process

Give your name, address, and phone number as required by the anti-money laundering regulations. The initial verification should be finished after the data has been submitted into the system. Clients are permitted to deposit, transfer, and withdraw funds following initial verification.

There are three ways to verify your account:

- Verification through the bank account: Follow the “Register Bank Account” link under the “Account Summary” section. Present your bank account information, including your account number (AN), the name of the city and nation where your account was created, the account’s currency, the phone number for your branch, the SWIFT (BIC) code, and a government-issued picture ID.

- Verification through the address: A certified copy of a utility bill (gas, water, or electricity bill). Your name and address must be distinct and readable in the photograph.

- Verification through Passport, Driver’s Licence, or Photo ID: Send a photo or scanned copy of your passport or ID. Spend some time on it and make sure you depict all sides or all pertinent pages.

Neteller Benefits & Disadvantages

Neteller Benefits & Disadvantages

Like every other thing in the world, Neteller has its advantages and disadvantages as well. We are going to look through them together. Let’s get started!

Neteller Pros

Neteller Pros

When depositing at your preferred online casinos, you should think about utilizing this method for several reasons:

- Available in 26 languages and more than 200 countries

- 24/7 customer service

- Accept payment in a variety of currencies, including Indian Rupees

- Quick

- Money transfers between Neteller accounts

Neteller Cons

Neteller Cons

Neteller, like anything else, has some drawbacks that we want you to be aware of. Here are a few aspects of Neteller that we find objectionable:

- For the transaction, fees are assessed.

- There are restrictions on how much money you may withdraw.

- When you deposit via Neteller, certain casinos do not provide bonuses.

Casino Deposits Using Neteller

Casino Deposits Using Neteller

Credit or debit cards are used to make deposits most often in India. Due to Indian law’s restrictions on bank account deposits outside of India, traders who utilize Neteller in India typically make deposits using credit/debit cards or Paytm.

With around 40 various ways to put money onto the account, anyone may use it for international deposits and withdrawals.

Create an account and review your alternatives if you are unclear about what will be the finest deposit method for your nation given that regulations vary from one nation to the next.

Casino Withdrawals Using Neteller

Casino Withdrawals Using Neteller

Customers have the option of withdrawing money from their accounts through a bank transfer, cheque, the company’s Net+ prepaid Mastercard, or an ATM.

Money is often withdrawn to the same form of payment or card used to deposit money for the majority of customers, particularly those in South East Asia. This is most frequently a credit or debit card in India.

The amount being withdrawn may be instantaneous or may take a few days, based on the account or personal card.

Supported Currencies By Neteller

Supported Currencies By Neteller

28 different currencies are supported by Neteller.

AED – United Arab Emirates Dirham, AUD – Australian Dollar, BGN – Bulgarian Lev, BRL – Brazilian Real, CAD – Canadian Dollar, CHF – Switzerland Franc, CNY – Chinese Yuan, COP – Colombian Peso, DKK – Danish Krone, EUR – EU Euro, GBP – British Pound, HUF – Hungarian Forint, INR – Indian Rupee, JPY – Japanese Yen, MAD – Moroccan Dirham, MXN – Mexican Peso, MYR – Malaysian Ringgit, NGN – Nigerian Naira, NOK – Norwegian Krone, PLN – Polish Zloty, RON – Romanian Leu, RUB – Russian Ruble, SEK – Swedish Krona, SGD – Singapore Dollar, TND – Tunisia Dinar, TWD – Taiwanese Dollar, USD – US Dollar, ZAR – South African Rand

*Please note that this list may be updated.

Fees & Transfer Times Using Neteller

Neteller levies varying fees at various points throughout a money transfer. When a user wants to upload money into the account, there is a transfer charge involved. Several methods, including foreign bank transfers, local bank deposits, Paysafecard, Skrill, UPI, Visa, and Visa Electron, are available for this.

On deposits, a normal fee of 2.5 percent is charged. A user must come up with a recurring cost of 1.45% starting at a minimum fee of $0.50 to transmit money.

Users are also entitled to favorable foreign currency rates. Neteller charges a foreign exchange fee of 3.99% on the current exchange rate if there is a currency conversion. However, depending on the VIP tier, this cost decreases significantly for VIP members, who may end up paying only 1%.

Safety & Security: Is it Safe To Use Neteller?

Safety & Security: Is it Safe To Use Neteller?

Neteller upholds incredibly high standards as a result of being approved by the UK’s Financial Conduct Authority. Its innovative security features combine physical and technological security measures to shield members from identity theft and fraud.

By enabling companies to take payments and send rewards virtually anywhere, this service gives its consumers a way to send money safely and anonymously throughout the world.

It has completed online transactions and handled electronic transfers for more than 20 years. Since then, this firm has kept building the safest platform available. Every deposit and withdrawal you make will guarantee the confidentiality of your personal and financial data.

Additionally, Neteller uses state-of-the-art encryption technology to protect all of its data. This business has added the “Verified by Visa” and “Mastercard SecureCode” authentication procedures to strengthen its security.

A preset password is supplied for each deposit made using a Visa or Mastercard to ensure that no unauthorized transactions are done on the site.

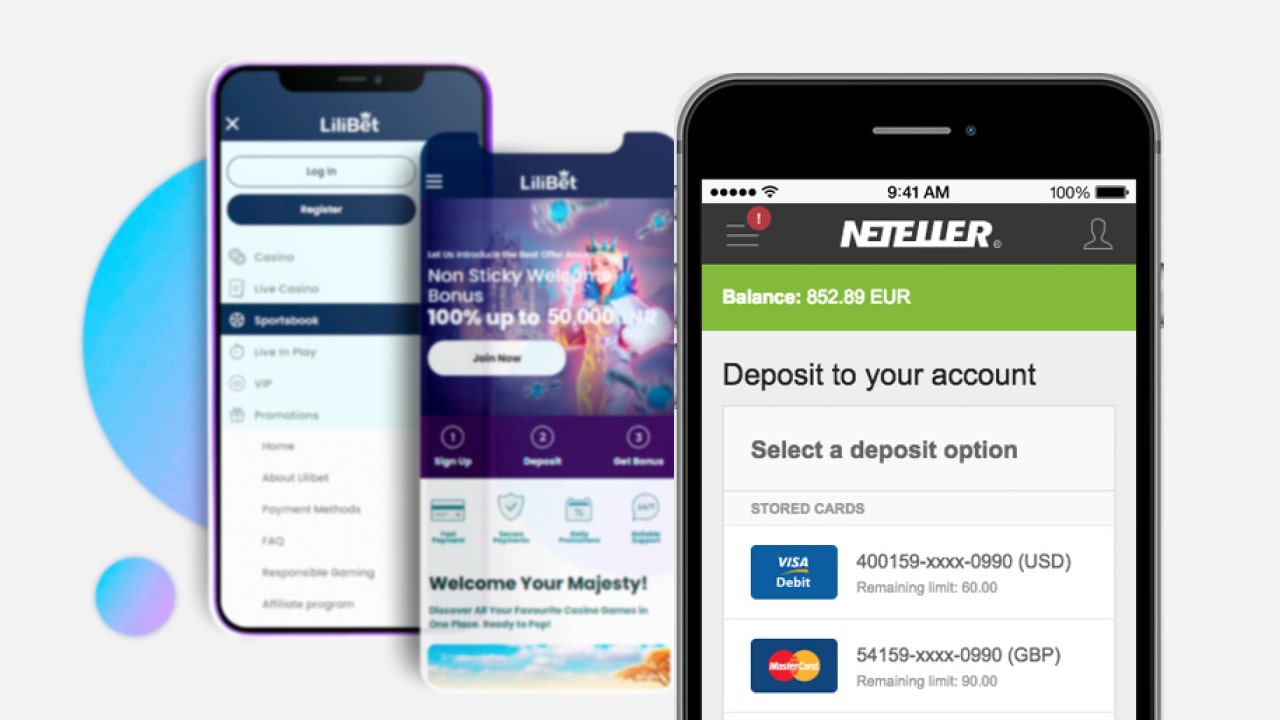

Neteller App Review

Neteller App Review

Customers may transfer, spend, and receive money while on the go thanks to the Neteller mobile app. It is a terrific method to guarantee that you always have access to all of your account’s features and is available on both the Apple App Store and the Google Play Store.

Increase or lower spending restrictions for your Net+ Mastercards while you’re on the road. Your app serves as your card everywhere wireless tap payments are accepted if your phone has RFID capability.

The app gives customers more control, making it essential for all users.

Neteller E-Wallet Review

Neteller E-Wallet Review

Your online casino accounts may be funded using Neteller e-wallet. When selecting a bank card or credit card to use in addition to your Neteller wallet, you should exercise caution. The reason is that it may be difficult for you to fund your account since some banks and credit cards (including Visa and MasterCard) may block your transaction. This is a result of the Reserve Bank of India’s Liberalized Remittance Scheme (RBI). As a result, fewer players may take as much cash out of the nation each year.

Nevertheless, there are various financial restrictions based on the purposes you designate. If you say you’d like to spend the money on gambling, you’ll get refused right away.

So, if you wish to make a deposit using Neteller, we advise using ICICI banks and their credit cards. In addition, you can utilize the Federal Bank of India. When it comes to Neteller deposits, these two banks have had success.

Neteller Alternative Methods

Although there are many advantages for players who choose this payment method to fund their casino accounts, other deposit options still exist. You may also finance your casino account using several more well-liked other options.

In this part, we’ll briefly go through them.

Skrill

Skrill

One of the most excellent payment methods is Skrill, which you may use for both in-store transactions and payments at the top casino websites. Skrill, which was established in 2001, functions similarly to Neteller.

One aspect of Skrill that we enjoy is that it has a reduced price structure than some of the other choices available. Additionally, it is one of the few e-wallet systems that accept Indian Rupees.

UPI

UPI

UPI is a leading payment option you should also take into account (Unified Payment Interface). The majority of gamblers adore utilizing it, making it one of the most well-liked casino deposit options. The ease of use and adaptability of UPI are the causes. Additionally, the majority of betting websites enable it.

The Reserve Bank of India oversees the Unified Payment Interface, which may be utilized for both deposits and withdrawals. UPI combines other payment options into its platform in an impressive way. It is one of the most well-liked ways to do local business within the nation.

Conclusion

Neteller distinguishes itself from rivals in part as a result of its commitment to providing the world’s quickest, easiest, and safest transfer service. The greatest service package of any transfer platform is made possible by the combination of client security, the network of online retailers, and the Net+ Mastercard.

By offering benefits tailored to a person’s needs, different tiers of membership enable consumers to get the most out of Neteller. Visit Neteller right away to cease having your finances limited.